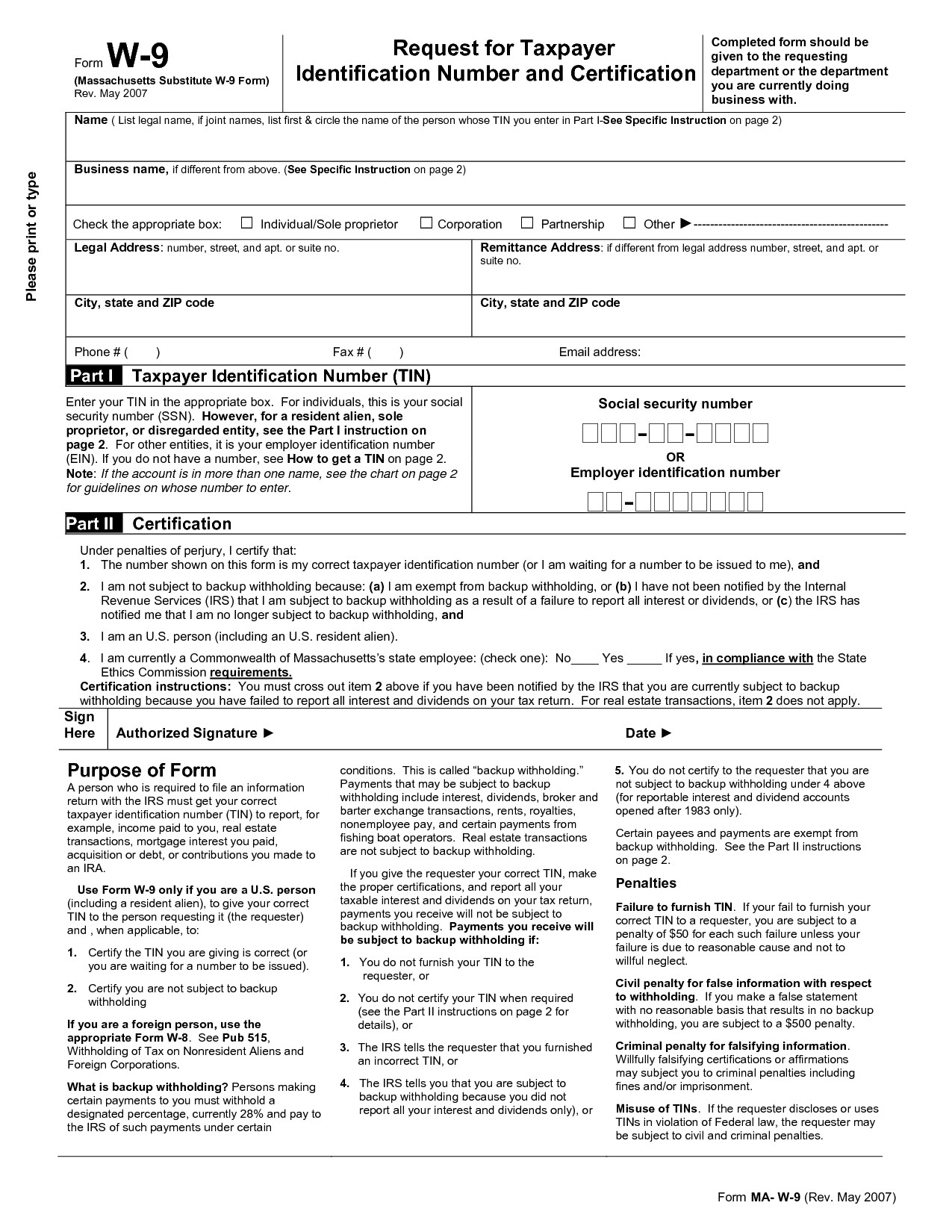

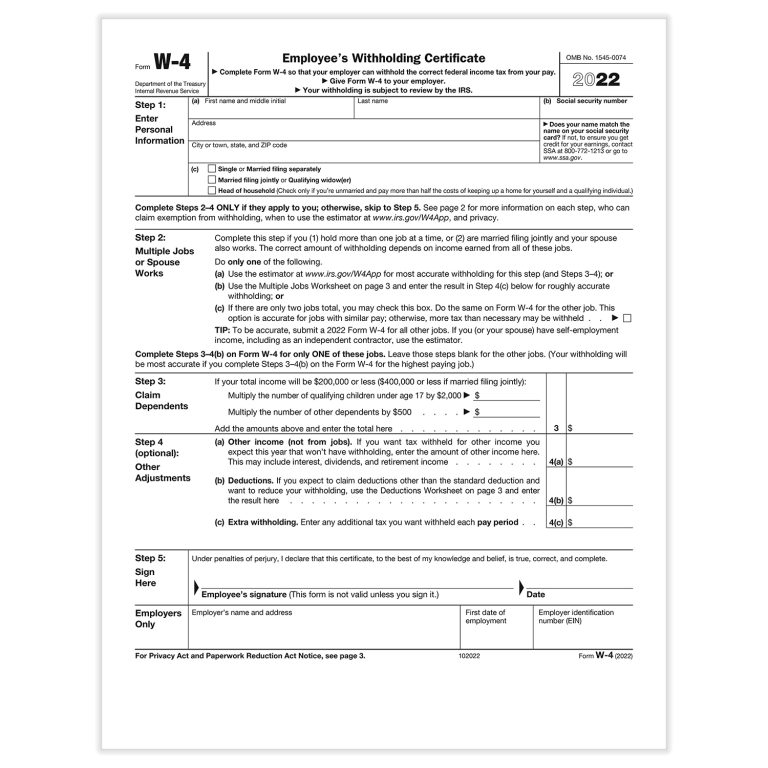

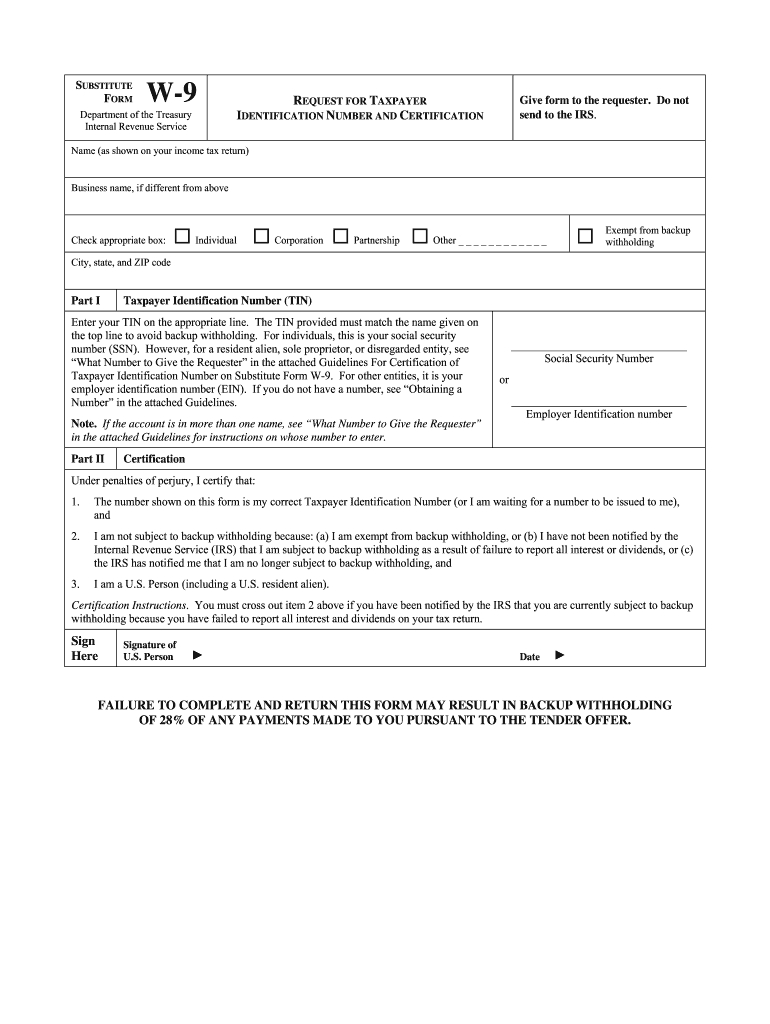

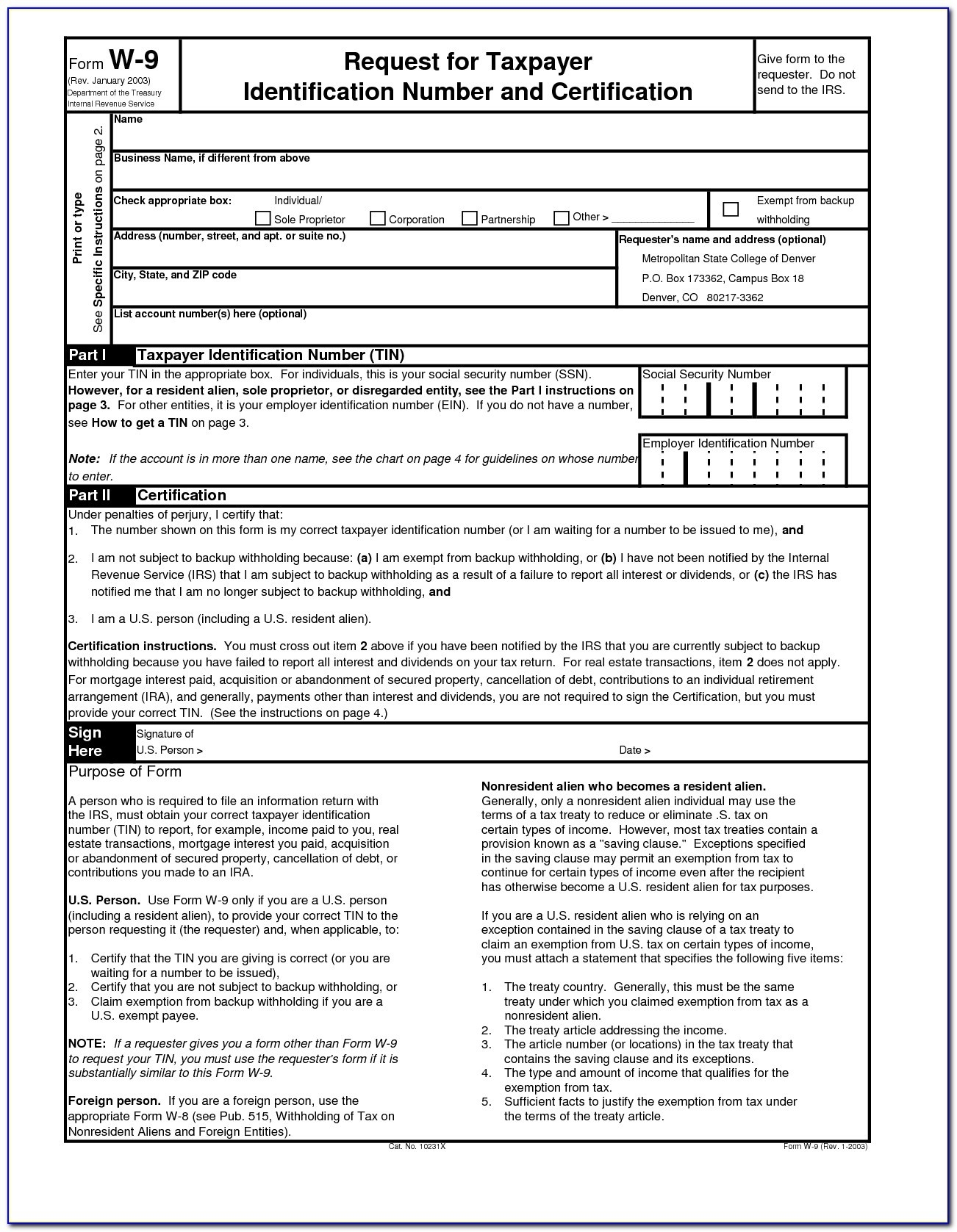

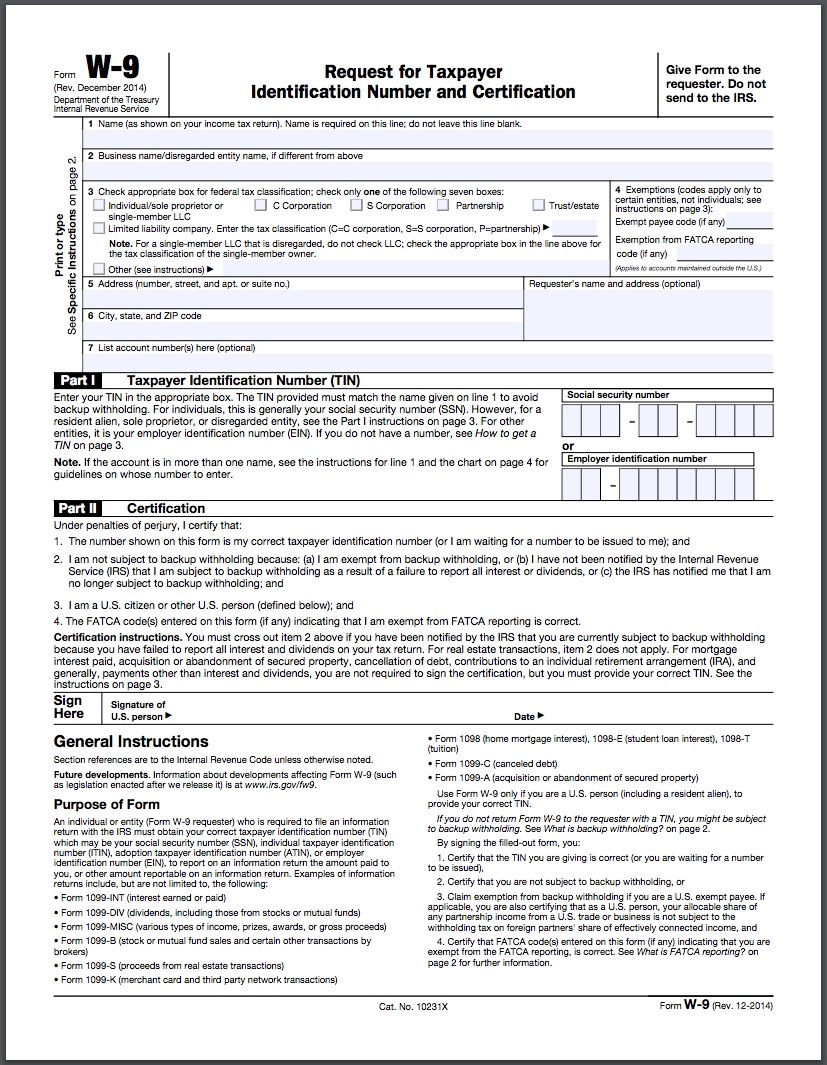

As a healthcare provider or contractor working with the Illinois Department of Public Health, you may be required to complete a W-9 form to provide your tax identification information. The W-9 form is a crucial document used by the Internal Revenue Service (IRS) to verify the identity and tax status of individuals and businesses. In this article, we will delve into the world of PDF W-9 forms, their significance, and how to fill them out accurately.

What is a W-9 Form?

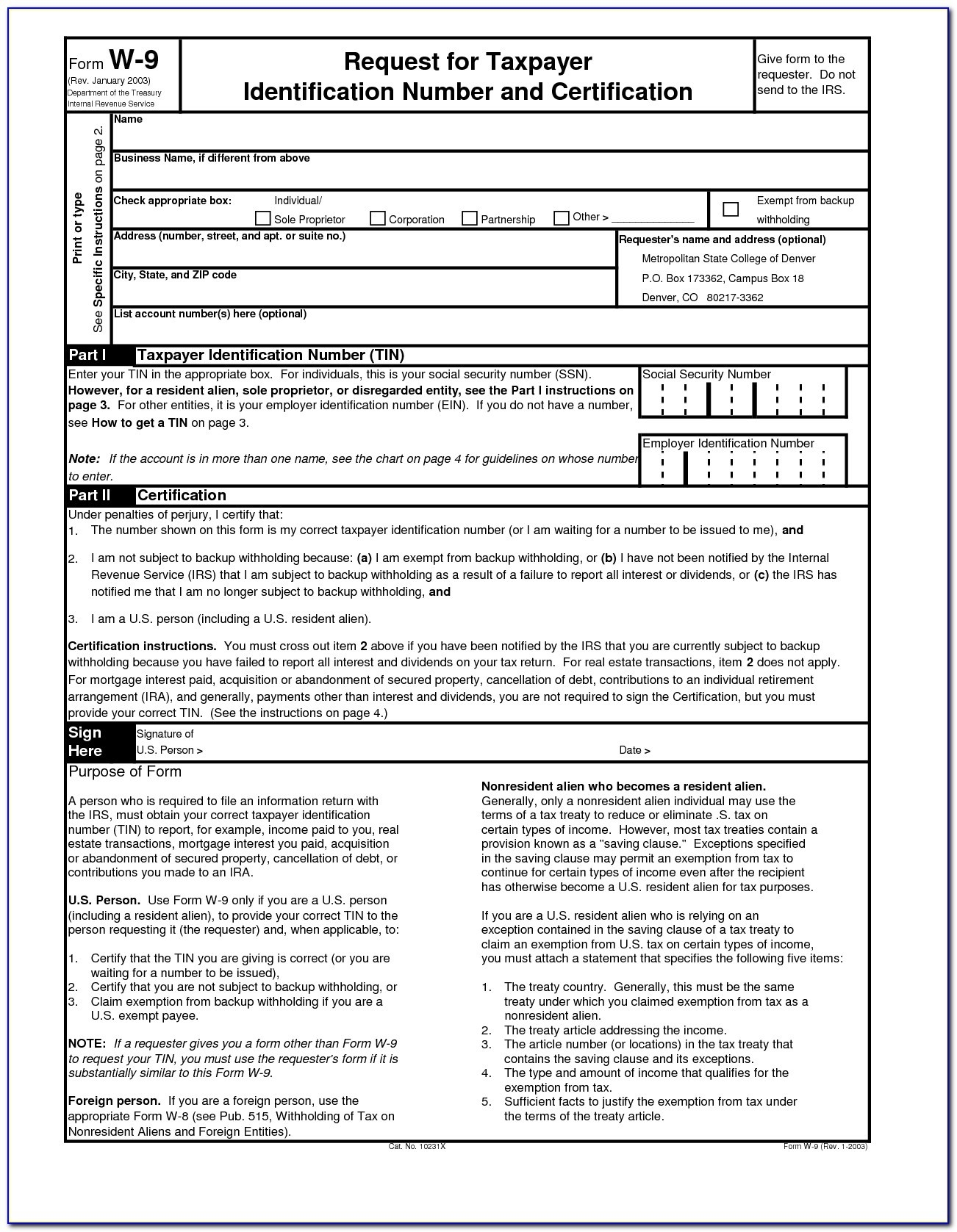

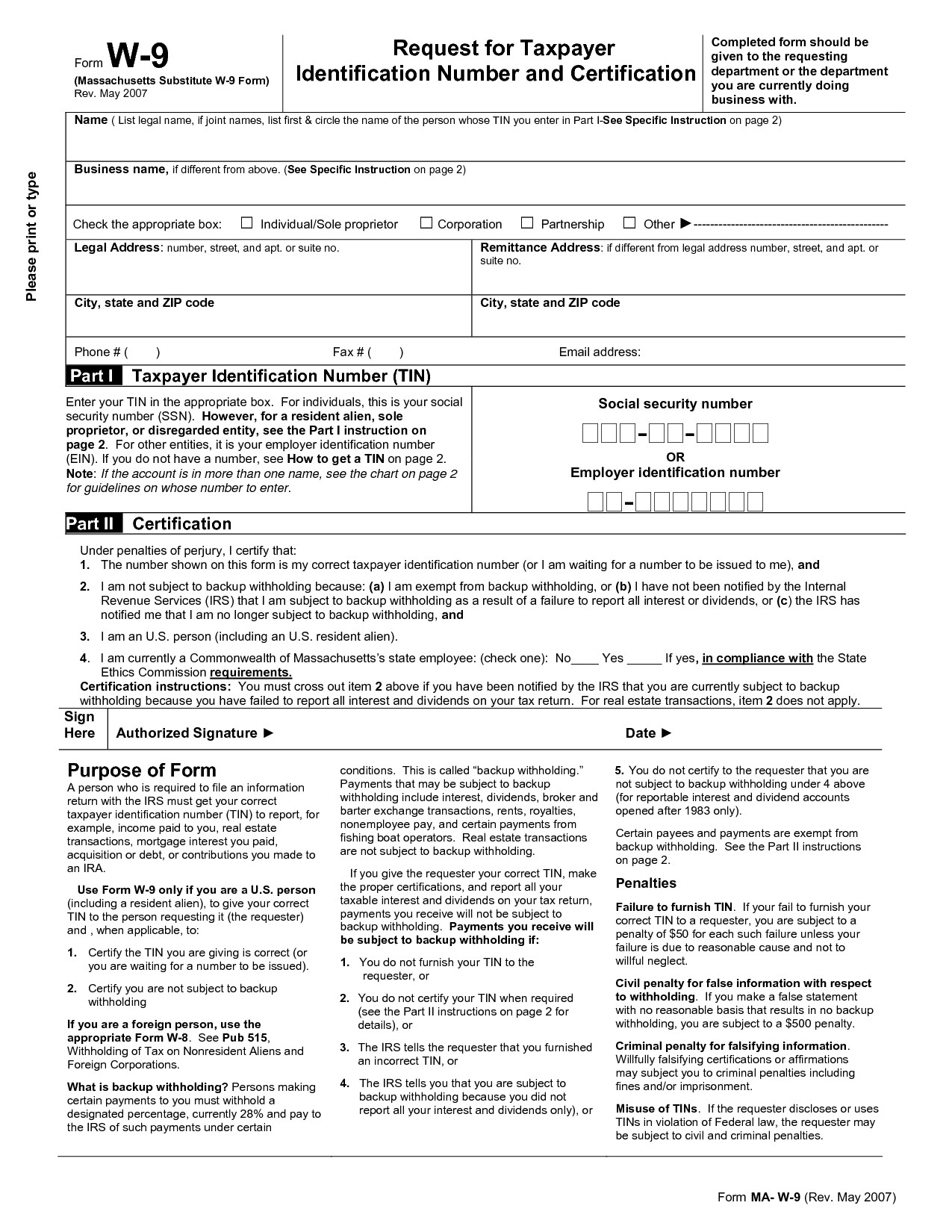

A W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the IRS to collect tax identification information from individuals and businesses. The form is typically used by payers, such as the Illinois Department of Public Health, to verify the identity and tax status of their vendors, contractors, and healthcare providers.

Why is a W-9 Form Required?

The W-9 form is required for several reasons:

Tax Compliance: The IRS uses the W-9 form to ensure that individuals and businesses are complying with tax laws and regulations.

Identity Verification: The form helps to verify the identity of individuals and businesses, reducing the risk of fraud and identity theft.

Tax Reporting: The W-9 form provides the necessary information for payers to report income and taxes to the IRS.

How to Fill Out a PDF W-9 Form

Filling out a PDF W-9 form is a straightforward process. Here are the steps to follow:

1.

Download the Form: You can download the PDF W-9 form from the IRS website or obtain it from the Illinois Department of Public Health.

2.

Fill Out the Form: Complete the form by providing your name, business name, address, and tax identification number (TIN).

3.

Sign the Form: Sign and date the form to certify that the information provided is accurate.

4.

Submit the Form: Submit the completed form to the Illinois Department of Public Health or other payer.

Importance of Accuracy

It is crucial to fill out the W-9 form accurately to avoid any delays or penalties. Make sure to:

Use the Correct TIN: Use your correct TIN, which can be either your Social Security number or Employer Identification Number (EIN).

Provide Accurate Address: Provide your accurate address to ensure that you receive important tax documents and notifications.

Sign the Form: Sign and date the form to certify that the information provided is accurate.

In conclusion, the PDF W-9 form is a critical document used by the IRS to verify the identity and tax status of individuals and businesses. As a healthcare provider or contractor working with the Illinois Department of Public Health, it is essential to understand the significance of the W-9 form and how to fill it out accurately. By following the steps outlined in this article, you can ensure that you provide the necessary information to comply with tax laws and regulations.