Tracking the Market's Pulse: An In-Depth Look at the Vanguard S&P 500 ETF (VOO) Price and News on Google Finance

Table of Contents

- VOO letter logo design on white background. VOO creative circle letter ...

- VOOとは?NISAでも買える?株価予想やVTIとの比較も紹介 | イーデス

- 25 important things you should know about Vanguard VOO ETF - Finny

- Here's Why You Should Buy Vanguard ETFs During the Market Meltdown ...

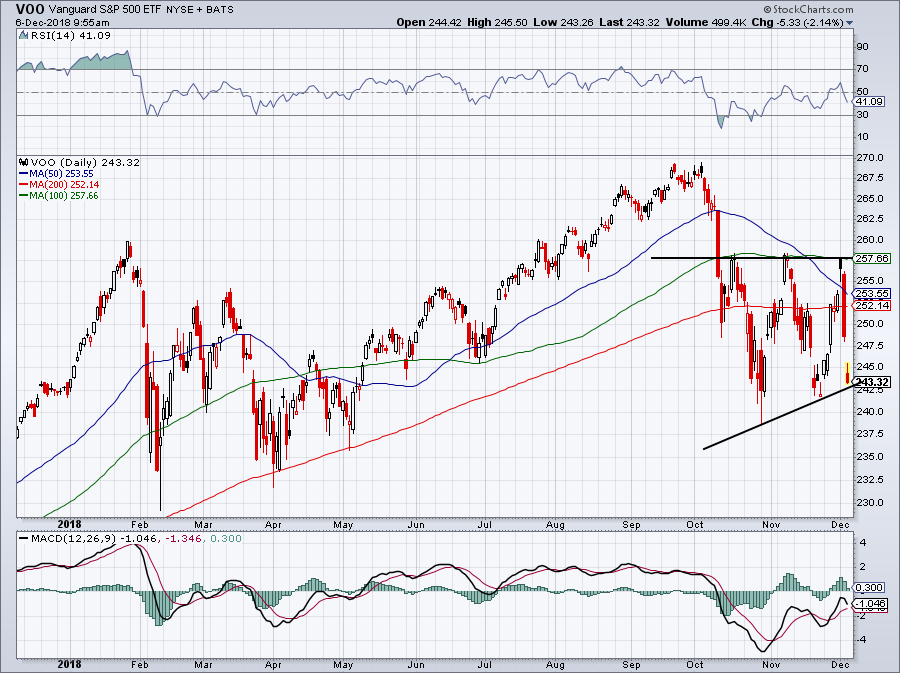

- Tradingview Supply And Demand Script Voo Stock Technical Analysis ...

- Vanguard 500 Index Fund (VOO) Stock Price, News, Quote & History ...

- VOO介紹:美股報酬最佳的ETF!慢慢變富的最好選擇,報酬以及風險分析 - 懶人經濟學

- VOO Stock Prediction 2025: A Comprehensive Analysis - 2025 Whole Year ...

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO vs SCHD: Which ETF is Better? — The Market Hustle

Current Price and Performance

Key Statistics and Holdings

News and Trends

Recent news and trends surrounding the Vanguard S&P 500 ETF (VOO) on Google Finance have been largely positive, with the ETF benefiting from a strong US economy and a bullish market sentiment. Some of the key news stories driving the ETF's performance include: The ongoing economic recovery from the COVID-19 pandemic The rise of the technology sector, led by companies such as Apple, Microsoft, and Amazon The growth of the healthcare sector, driven by advances in medical technology and an aging population The impact of monetary policy decisions by the Federal Reserve on the overall market The Vanguard S&P 500 ETF (VOO) is a popular and widely traded ETF that offers investors a diversified portfolio of the 500 largest publicly traded companies in the US. With its strong track record of performance, diverse portfolio, and low expense ratio, the VOO ETF is an attractive option for investors looking to gain exposure to the US stock market. By tracking the current price and news surrounding the VOO ETF on Google Finance, investors can stay up-to-date on the latest market trends and make informed investment decisions.For more information on the Vanguard S&P 500 ETF (VOO) and other investment opportunities, visit Google Finance today.

Note: The prices and statistics mentioned in this article are subject to change and may not reflect the current market situation. It's always recommended to consult with a financial advisor or conduct your own research before making any investment decisions. Word count: 500 Meta Description: Get the latest news and price updates on the Vanguard S&P 500 ETF (VOO) on Google Finance. Learn about its performance, key statistics, and what it means for investors. Keyword: Vanguard S&P 500 ETF (VOO), Google Finance, ETF, stock market, investment, S&P 500 index.