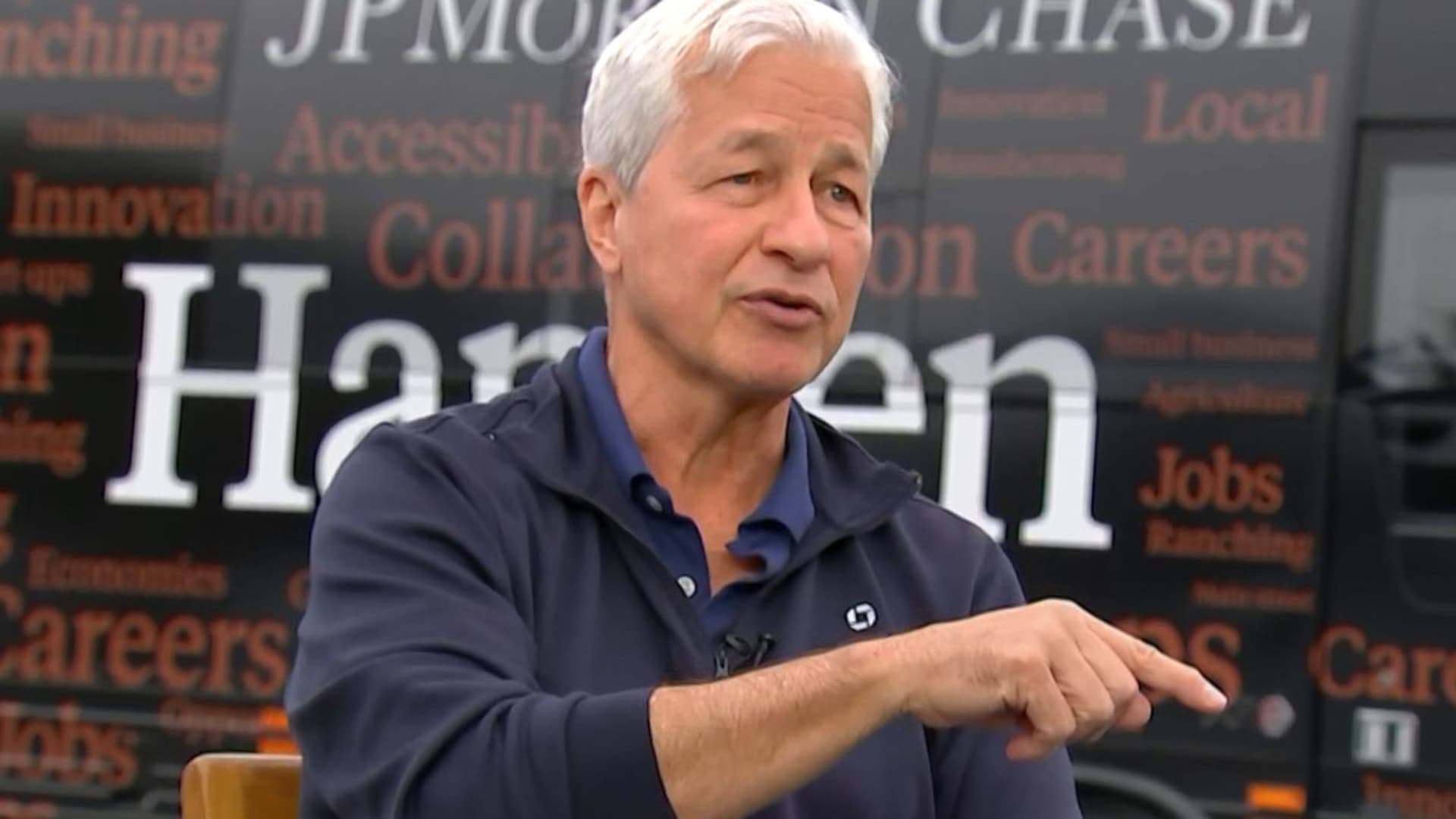

JPMorgan Chase CEO Jamie Dimon Sounds Alarm on Looming Economic Downturn Amid Trade Tensions

Table of Contents

- JPMorgan’s Jamie Dimon says interest rates ‘may go up more,’ says he ...

- Jamie Dimon

- Jamie Dimon to sell 1 million shares of JPMorgan - FeeOnlyNews.com

- Jamie Dimon says Trump 'wasn't wrong' about critical issues, warns ...

- JPMorgan Defeats Bid to Depose Dimon Again in Epstein Suit by US Virgin ...

- Jamie Dimon, JP Morgan CEO, to be deposed in Epstein suits | CNN Business

- Jamie Dimon slams anti-return to office petitioners | Fox Business

- Jamie Dimon Net Worth: Fortune explored as CEO of JPMorgan Chase ...

- Inflation alarm, 'extraordinary' AI: 4 takeaways from Jamie Dimon's ...

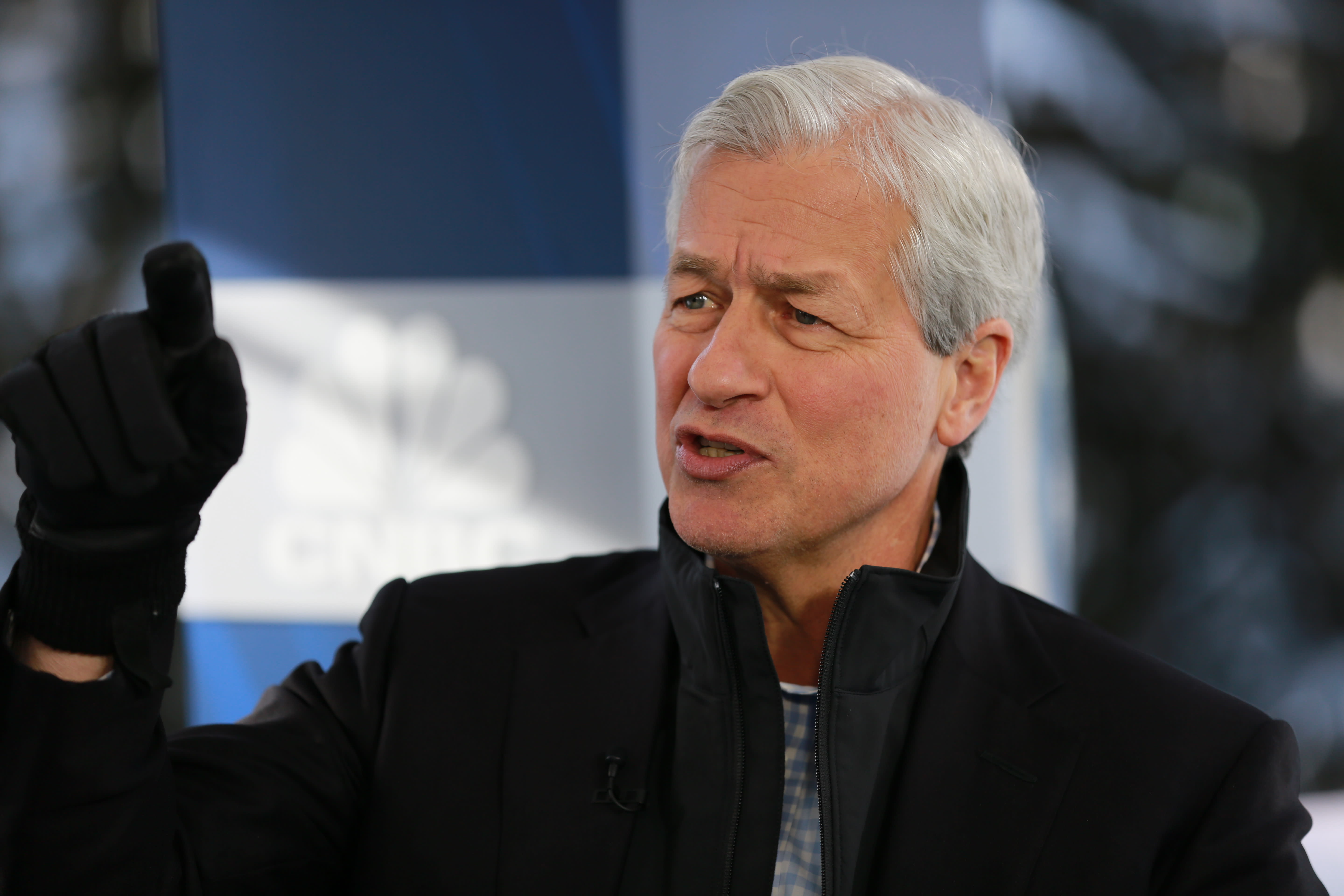

- Jamie Dimon rattled the markets last year by comparing the coming ...

The trade tensions, which have been escalating over the past year, have already begun to take a toll on the global economy. The imposition of tariffs on imported goods has led to increased costs for consumers and businesses, resulting in reduced demand and lower economic growth. Dimon's warning comes at a time when the global economy is already showing signs of slowing down, with the International Monetary Fund (IMF) predicting a decline in global growth to 3.3% in 2023, down from 3.8% in 2022.

The Risks of a Prolonged Trade War

Dimon's warning is not an isolated one. Other experts and business leaders have also expressed concerns over the potential economic fallout from the trade war. The CEO of the US Chamber of Commerce, Thomas Donohue, has warned that the trade war could lead to a recession, while the International Monetary Fund (IMF) has cautioned that the trade tensions could reduce global economic growth by up to 0.8% by 2023.

What's Next for the Global Economy?

As the trade tensions continue to escalate, it is essential for businesses and investors to be prepared for the potential economic downturn. Some possible steps that can be taken include: Diversifying Investments: Investors can diversify their investments to reduce their exposure to the trade war. Building Cash Reserves: Businesses can build cash reserves to prepare for potential disruptions to their supply chains. Monitoring Trade Developments: Staying informed about the latest trade developments can help businesses and investors make informed decisions.In conclusion, Jamie Dimon's warning of an impending economic downturn is a timely reminder of the potential risks associated with the ongoing trade tensions. As the global economy continues to navigate these uncertain times, it is essential for businesses and investors to be prepared for the potential economic pain that may lie ahead.