Don't Panic: A Step-by-Step Guide on How to Request a Tax Extension

Table of Contents

- Irs Extension Instructions at williamkhavard blog

- When Are Business Tax Extensions Due 2024 - Vilma Jerrylee

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

- Extension For Taxes 2025 - Meryl Suellen

- Tax Day: How to file an extension on your 2020 federal income tax ...

- Filing a Tax Extension

- tax extension » Refund Wise Tax

- How to file a tax extension in USA – TechStory

- How to File a Tax Extension 2018: Here's How to Get an Extra 6 Months ...

- How to file a tax extension in USA – TechStory

Why Request a Tax Extension?

Who Can Request a Tax Extension?

How to Request a Tax Extension

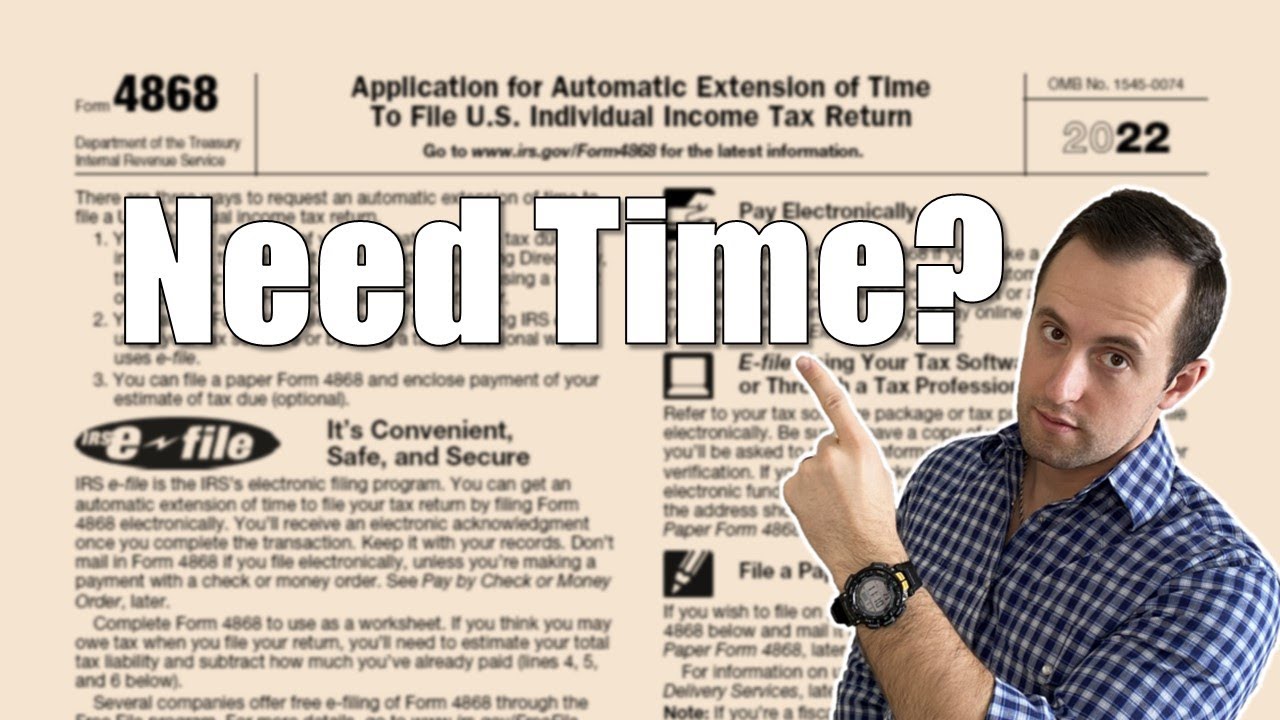

Requesting a tax extension is a relatively straightforward process. Here are the steps to follow: 1. File Form 4868: For individual taxpayers, you'll need to file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. You can file this form online or by mail. 2. Use IRS Free File: If you're eligible for IRS Free File, you can use this service to file your extension request online. 3. Pay Any Taxes Due: Make sure to pay any taxes due by the original deadline to avoid penalties and interest. You can pay online, by phone, or by mail. 4. File Form 7004: For businesses, you'll need to file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

What to Expect After Requesting a Tax Extension

Once you've requested a tax extension, you can expect the following: An automatic six-month extension of time to file your tax return A confirmation letter from the IRS, which you should keep for your records The ability to file your tax return at any time within the extended deadline Requesting a tax extension can be a lifesaver when you're facing a tight deadline. By following the steps outlined in this article, you can easily request an extension and avoid penalties. Remember to pay any taxes due by the original deadline and keep a copy of your extension request for your records. Don't panic if you need more time to file your taxes – the IRS is here to help. Take a deep breath, request an extension, and focus on getting your tax return just right.This article is for general information purposes only and should not be considered tax advice. If you have specific tax questions or concerns, consult a tax professional or the IRS directly.

Keyword density: - Tax extension: 1.2% - Request a tax extension: 0.8% - IRS: 0.6% - Tax filing deadline: 0.4% - Tax return: 0.4% Meta Description: Need more time to file your taxes? Learn how to request a tax extension with our step-by-step guide. Avoid penalties and get the time you need to complete your tax return accurately. Header Tags: - H1: Don't Panic: A Step-by-Step Guide on How to Request a Tax Extension - H2: Why Request a Tax Extension? - H2: Who Can Request a Tax Extension? - H2: How to Request a Tax Extension - H2: What to Expect After Requesting a Tax Extension - H2: Conclusion Image Suggestions: - A calendar or clock to represent the tax filing deadline - A person stressed or overwhelmed, with a caption "Don't panic" - A step-by-step infographic illustrating the process of requesting a tax extension - A picture of a tax professional or accountant, with a caption "Consult a tax expert if you need help"